Mannheim energy company invests Euro 140 million in new plant south east of London - Slight sales growth in first half of current 2012/13 financial year, earnings match previous year's figure - Forecast confirmed

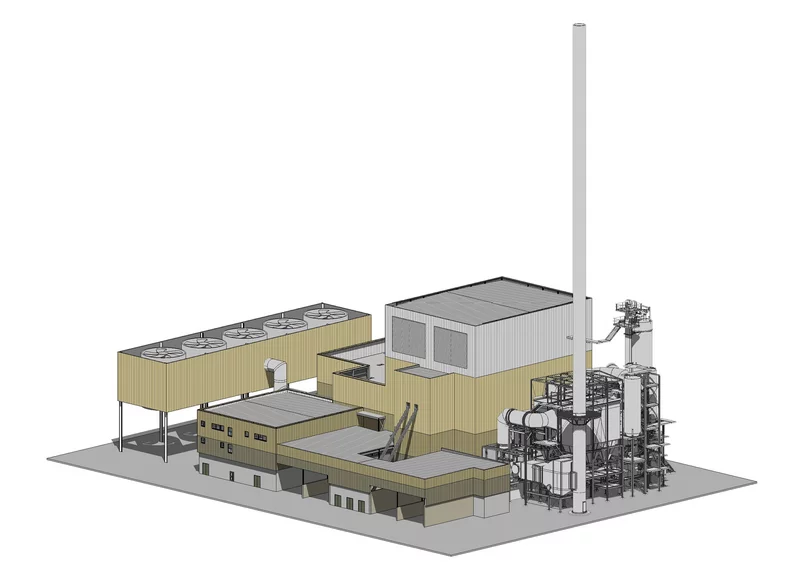

The Mannheim-based energy company MVV Energie (WKN: A0H52F, ISIN: DE000A0H52F5) is building a new biomass power plant with a net electricity output of around 23 MW at Ridham Dock, an industrial port 30 kilometres south east of London. As reported by Dr. Georg Müller, CEO of the energy group, at the presentation of the financial report for the first six months of the current 2012/13 financial year in Mannheim on Wednesday, MVV Energie will be investing around Euro 140 million in the new plant. "We will be drawing on the same wealth of technological and operating expertise that has already made us one of the market leaders in the biomass business in Germany." Operations at the power plant, on which construction work began in April, are due to be launched in spring 2015.

The plant will use around 172 000 tonnes of old timber from the surrounding region to generate almost 188 million kilowatt hours of electricity a year - enough to cover the electricity needs of 60,000 households. Not only that, by working with cogeneration the power plant should also supply heating energy to neighbouring industry.

"This represents our first investment in biomass-based energy generation abroad", stressed company CEO Dr. Müller. Just last year, the Mannheim-based energy company began work on building an energy from waste plant in Plymouth in south-western England, as well as taking over a waste-powered cogeneration plant in Liberec in the Czech Republic, where it is already one of the leading district heating suppliers. "What counts most for us is to implement economically attractive projects in reliable political and legal frameworks. That is the case in both the UK and the Czech Republic."

With its new power plant in Ridham Dock, MVV Energie is consistently maintaining its strategic investment programme aimed at expanding renewable energies and boosting energy efficiency. By 2020, the company intends to channel around three billion euros into both new growth and its existing proprietary plants and grids. The company has already invested almost two billion euros since the programme was launched in 2009. Comments Dr. Müller: "We have our target firmly in our sights and are making very good progress with the investments in our future."

Alongside biomass, MVV Energie is relying above all on onshore wind power and environmentally-friendly district heating. By acquiring the Spanish energy group Iberdrola's German wind parks at the beginning of the year, the Group has thus almost doubled its wind power capacity to an installed capacity of 144 MW. At the same time, it is currently building Germany's highest-capacity district heating storage facility on the site of the large power plant in Mannheim (Grosskraftwerk Mannheim). For MVV's CEO these all represent "investments in the future to prepare our company for a new energy system in which renewable energies will assume the leading role".

According to Dr. Müller, this period of transition is currently marked by political uncertainty and radical change in the energy industry. "That no real breakthrough in terms of laying the necessary groundwork was to be expected in the year of a general election is not entirely surprising. Having said that, the entire industry is waiting in particular for the Renewable Energies Act (EEG) to be reformed and for key features of the new market design to be defined."

He characterised the fundamental conversion in the energy supply as a lengthy process presenting great challenges for politicians, the economy, energy companies and society alike. The politicians would have to create a reliable framework and targeted incentives to trigger the necessary investments. Remarked Dr. Müller: "We need a competition-based, cost-efficient market model, one in which both conventional and renewable energies have a role to play." He is convinced that conventional power plants will be needed in future as well to offset fluctuations in the electricity volumes generated by solar and wind power.

Stable earnings with slight sales growth

Given the difficult market climate and the fact that CO2 rights, previously allocated free of charge, have had to be purchased in full since the beginning of the year, the CEO expressed his satisfaction with the company's economic performance in the first half of its current 2012/13 financial year (1 October 2012 - 31 March 2013). MVV Energie managed to increase its external sales year-on-year by 7 percent to Euro 2.2 billion. At Euro 180 million, its adjusted operating earnings (adjusted EBIT) matched the previous year's figure.

The company benefited in this respect from the drawn-out cold winter. As a result, heating energy turnover grew by an average of around 10 percent compared with the previous year. Not only that, the Mannheim company also managed to boost the sales generated in its new segment of directly marketing renewable energies via the so-called market premium model by around Euro 70 million. Remarked Dr. Müller: "That makes us one of the leading providers in this area. Not least, it means we are playing an important role in pioneering the market integration of renewable energies." When it comes to directly marketing electricity from photovoltaics, MVV Energie is now even the top player in Germany. The company currently markets electricity from photovoltaic systems with a capacity of 1,000 MW, equivalent to one third of the output directly marketed in Germany.

Earnings were held back by the discontinuation of earnings contributions from the shareholding sold in Stadtwerke Solingen, as well as by the low wholesale electricity price as reflected in the persistently low electricity generation margin (clean dark spread). Alongside these factors, earnings were affected above all by the decline in revenues from waste deliveries and by the loss of earnings between October and December due to unforeseeable damages at cogeneration plants at the MVV Umwelt subgroup.

Forecast confirmed

The Group has confirmed its own forecast for the 2012/13 financial year as a whole. From an operating perspective, MVV Energie still expects its sales to slightly exceed the high level of Euro 3.9 billion reported for the previous year. Overall, the company expects its adjusted EBIT to fall around 5 percent short of the figure of Euro 223 million reported for the 2011/12 financial year. Dr. Müller: "We are continuing to make targeted, substantial investments to expand renewable energies and achieve greater energy efficiency and are thus actively contributing towards converting the energy supply."

| Key figures of the MVV Energie Group 1 October 2012 to 31 March 2013 | |||

| Euro million | 1.10.2012 to 31.3.2013 | 1.10.2011 to 31.3.2012 | % change |

| External sales excluding electricity and natural gas taxes | 2 231 | 2 090 | + 7 |

| Adjusted EBITDA1 | 261 | 260 | 0 |

| Adjusted EBITA1 | 180 | 180 | 0 |

| Adjusted EBIT2 | 180 | 180 | 0 |

| Adjusted EBT2 | 147 | 148 | - 1 |

| Adjusted annual net surplus for period 2 | 101 | 101 | 0 |

| Adjusted annual net surplus after minority interests2 | 78 | 87 | - 10 |

| Adjusted earnings per share 2 in Euro | 1.19 | 1.32 | - 10 |

| Cash flow before working capital and taxes | 281 | 261 | + 8 |

| Cash flow before working capital and taxes per share in Euro | 4.26 | 3.96 | + 8 |

| Free cash flow | - 104 | - 237 | + 56 |

| Adjusted total assets (at 31.3.2013 / 30.9.2012)3 | 4 141 | 3 854 | + 7 |

| Adjusted equity (at 31.3.2013 / 30.9.2012)3,4 | 1 417 | 1 390 | + 2 |

| Adjusted equity ratio (at 31.3.2013 / 30.9.2012)3,4 | 34.2% | 36.1% | - 5 |

| Investments | 164 | 145 | + 13 |

| Number of employees (at 31.3.2013 / 31.3.2012) | 5 462 | 5 873 | - 7 |

| 1 | excluding non-operating IAS 39 derivative measurement items, before restructuring expenses and including interest income from finance leases |

| 2 | excluding non-operating IAS 39 derivative measurement items, excluding restructuring expenses and including interest income from finance leases |

| 3 | excluding non-operating IAS 39 derivative measurement items |

| 4 | figures as of 30.9 2012 adjusted. Details can be found in the Business Performance chapter in the financial report |